Pension Funds

Change of Pension Fund Manager

In case performance of an AMC is not satisfactory the client may change Fund Manager without redeeming investment.

Allocation scheme:

The client has an option to select allocation scheme from low risk to the high risk levels. Please refer to respective Fund features for detail. Our team will provide a detailed guideline so that our clients chose the most beneficial investment allocation.

Change in investment Allocation:

The allocation could be changed at any time twice in a year.

Retirement:

Retirement could be filed anytime between 60 to 70 years of age.

On retirement up to 50% of accumulated balance could be withdrawn. In case of death the client’s nominees or in case of disability before retirement the client may withdraw up to 50% upfront tax free. The remaining amount will used to make pension payments.

Taxation of Pension payments:

Pension payments including principal and profits are exempt from tax.

Free Takaful:

AMCs also offer free Takaful coverage and refer to respective fund features for detail.

Exit from Scheme:

Amount accumulated in IPA could be withdrawn at any time, however the amount of tax credit obtained is to be refunded, calculated at average tax rate of last three years.

Kifayah Investment management is an authorized distributor for Pension Funds under management of Al Meezan Investment Management.

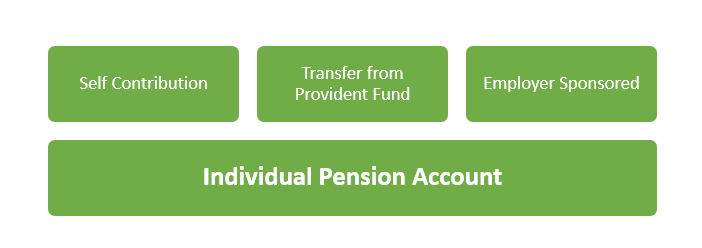

Investments in Pension Fund through our platform gives the following advantages at no cost to our investors.

- Unbiased advise;

- Tax Credit;

- Choice of multiple funds;

- Access to our research.

- Free for investors (our services fee is paid by respective fund manager).

Fund Details

| Fund Manager | Al Meezan Investment Management Limited |

| Fund Name | Meezan Tahaffuz Pension Fund |

| Scheme Type | Open-end Islamic Voluntary Pension Scheme |

| Date of Inception | 28-Jun-07 |

| Fund Size – June, 2019 | Rs. 9,008 Million |

| Objective of the scheme | To provide participants a regular Halal income at the time of retirement |

| Allocation Schemes | Six Asset Allocation Schemes: |

| 1. High Volatility | |

| 2. Medium Volatility | |

| 3. Low Volatility | |

| 4. Lower Volatility | |

| 5. Life Cycle Plan | |

| 6. Customized Allocation | |

| Minimum Investment Amount | Rs.1,000 |

| Management Fee | 1.50% |

| Entry Load | 3% |

| Exit Load | Nil |

Fund Performance Highlights

| Fund Manager | Fund Name | Equity Sub Fund* | Debt Sub Fund** | Money Market Sub Fund** |

| Al Meezan Investment Management Limited | Meezan Tahaffuz Pension Fund | 17.26% | 9.97% | 9.95% |

*10 year CAGR (FY10-FY19)

** 3-month returns