Kifayah Strategy of Mutual Funds

You can select from a wide variety of high-quality Shariah compliant mutual funds to match your unique investment goals and risk appetite.

Mutual Funds range from low risk Money Market and Income Funds to high risk Equity Funds. Money Market and Income Funds are suitable for low risk investors requiring regular monthly income etc. These funds invest with Shariah Compliant Banks, Shariah compliant windows of Conventional Banks and Corporate and Government Sukuks. Equity Funds are suitable for investors looking for higher returns who have the appetite to take higher risk. These Funds invest in quality stocks listed at Pakistan stock exchange.

Kifayah Investment management is an authorized distributor for mutual funds under the management of Al Meezan Investment Management Limited.

Investments in Mutual Fund through our platform gives the following advantages at no cost to our investors:

- Independent advise;

- Choice of multiple funds;

- Access to our research;

- Free for investors (our services fee is paid by respective fund manager).

This product is suitable for investors who are seeking:

- Long term wealth creation solution

- To save taxes

- Diversified Investment that aims for capital appreciation by investing in Shariah compliant equity securities

- High return potential

- To cover themselves against inflation, and falling Rupee value

- To invest for long term.

This product is suitable for investors who are seeking:

- Protection of investments from stock market volatility, while providing diversification to the overall investment portfolio

- Long term regular income solution

- Moderate return potential

This product is suitable for investors who are seeking:

- Parking avenue for short-term funds

- Stable and Halal returns avoiding volatility of both long-term fixed income securities and stock markets

- Low risk

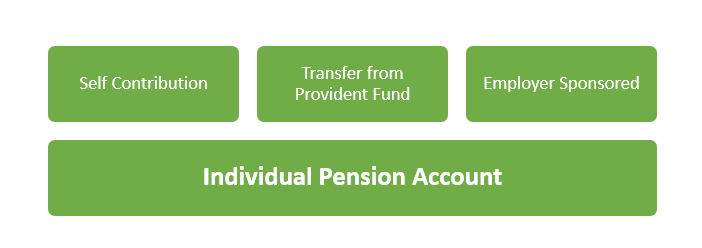

Kifayah Strategy of Pension Funds

Change of Pension Fund Manager

In case performance of an AMC is not satisfactory the client may change Fund Manager without redeeming investment.

Allocation scheme:

The client has an option to select allocation scheme from low risk to the high risk levels. Please refer to respective Fund features for detail. Our team will provide a detailed guideline so that our clients chose the most beneficial investment allocation.

Change in investment Allocation:

The allocation could be changed at any time twice in a year.

Retirement:

Retirement could be filed anytime between 60 to 70 years of age.

On retirement up to 50% of accumulated balance could be withdrawn. In case of death the client’s nominees or in case of disability before retirement the client may withdraw up to 50% upfront tax free. The remaining amount will used to make pension payments.

Taxation of Pension payments:

Pension payments including principal and profits are exempt from tax.

Free Takaful:

AMCs also offer free Takaful coverage and refer to respective fund features for detail.

Exit from Scheme:

Amount accumulated in IPA could be withdrawn at any time, however the amount of tax credit obtained is to be refunded, calculated at average tax rate of last three years.

Kifayah Investment management is an authorized distributor for Pension Funds under management of Al Meezan Investment Management.

Investments in Pension Fund through our platform gives the following advantages at no cost to our investors.

- Unbiased advise;

- Tax Credit;

- Choice of multiple funds;

- Access to our research.

- Free for investors (our services fee is paid by respective fund manager).