Retirement Fund Services

Investment Advisory Services and Separately Managed Accounts

The Retirement Fund managers have the liberty of making asset allocation as they have long term funds and the trustees can make the best use of the fund assets by investing them in coordination with an advisor.

The regulators are also keen to see retirement fund managers making optimum asset allocation for the benefit of their members/ participants and therefore SECP has made it mandatory to appoint an Investment Advisor where the investment in listed securities is over Rs 50 million.

We work with retirement fund managers and trustees in managing their Retirement Fund Trust according to rules laid down by the regulators. These rules specify the investment limits. Click to know more about Investment Advisory Services and Separately Managed Accounts.

As an outsourced services providers we take on the role of accounting of the Fund, wherein we:

- Maintain general ledger;

- Prepare annual accounts;

- Coordinate with auditors for audit;

- Coordinate with actuary for actuarial valuations; and

- Perform other accounting activities.

As an outsourced services providers we take on the role of administration of the Fund, wherein we:

- Check compliance in processing of loans etc for employees;

- Present Fund performance to Trustees;

- Assist actuary of Fund in actuarial valuation (where applicable);

- Profit allocation to each employee;

- Carry out employee accounting (applicable to Provident Funds and other defined contribution plans) including issuance of Statements to each employee;

- Maintaining members and loan record for each member of the trust;

- Implement internal controls including bank and securities reconciliations.

As an outsourced services providers we take on the role of regulatory compliant of the Fund, wherein we:

- File six monthly reporting to SECP.pdf

- Submit annual and other reporting to FBR; and

- Ensure that Investments are made within compliance limits;

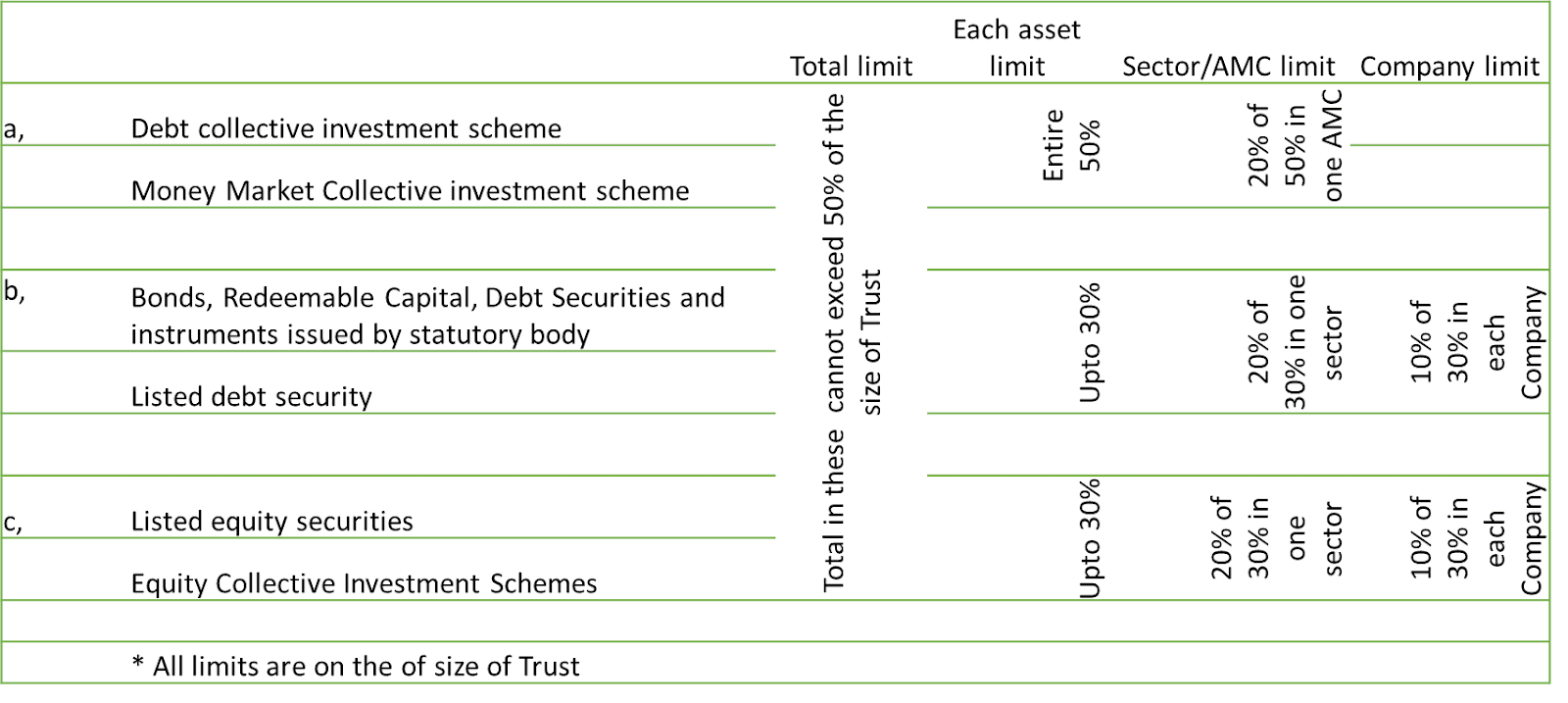

Securities and Exchange Commission of Pakistan (SECP) has given a detailed outline for investments by Provident and other Contributory Funds:

Investment Compliance limits

A. Conditions for investment in shares of listed companies:

- A minimum profitable operational record of immediate three preceding years;

- Average dividend of not less than fifteen percent to the shareholders during two out of three preceding consecutive years;

- The minimum free float of the Company shall not be less than fifteen percent or fifty million shares whichever is higher; and

- Breakup value equivalent or more than the par value of the shares of such company.

Please contact us for list of stocks eligible for investments by retirements Fund.

B. Conditions for investment in listed and unlisted TFCs, Sukuks and Debt Mutual Funds:

| listed and unlisted TFCs, SUKUKs | Debt Mutual Funds | Money Market | |

| Rating | A with stable outlook | A with stable outlook | AA- |

C. Conditions for investment in IPO of equity securities:

- Company having profitable operational record;

- Fund or Trust, shall not subscribe to an IPO of equity securities underwritten in any way by its associated companies or associated undertakings; and

- Fund or Trust, shall not subscribe to an IPO of a greenfield project;

- Contact us for a presentation to Trustees;

- Finalise Investment Policy Statement;

- Sign up our agreement.

Our deliverables:

- Analysis of portfolio for reallocation;

- Active portfolio management;

- Active rebalancing of portfolio;

- Communicating emerging investment opportunities;

- Reporting on performance as per benchmark.

Fee Structure:

| (i) Advisory | Higher of Rs 42,000 or 0.2% of portfolio per annum |

| (ii) Separately Managed Accounts | Higher of Rs 42,000 or 1% of portfolio per annum |

| (iii) Accounting, Administration and regulatory compliance | To be mutually agreed. |